As Retail shifts online the amount of physical space required per capital is shrinking CBRE outlook 2021

Contact

As Retail shifts online the amount of physical space required per capital is shrinking CBRE outlook 2021

2020 saw the retail sector in Australia recalibrate as lockdowns, trading restrictions and border closures impacted trading conditions and shifted consumer demand.CBRE Market Outlook 2021 Kate Bailey Head of Logistics and Retail Research CBRE Australia.

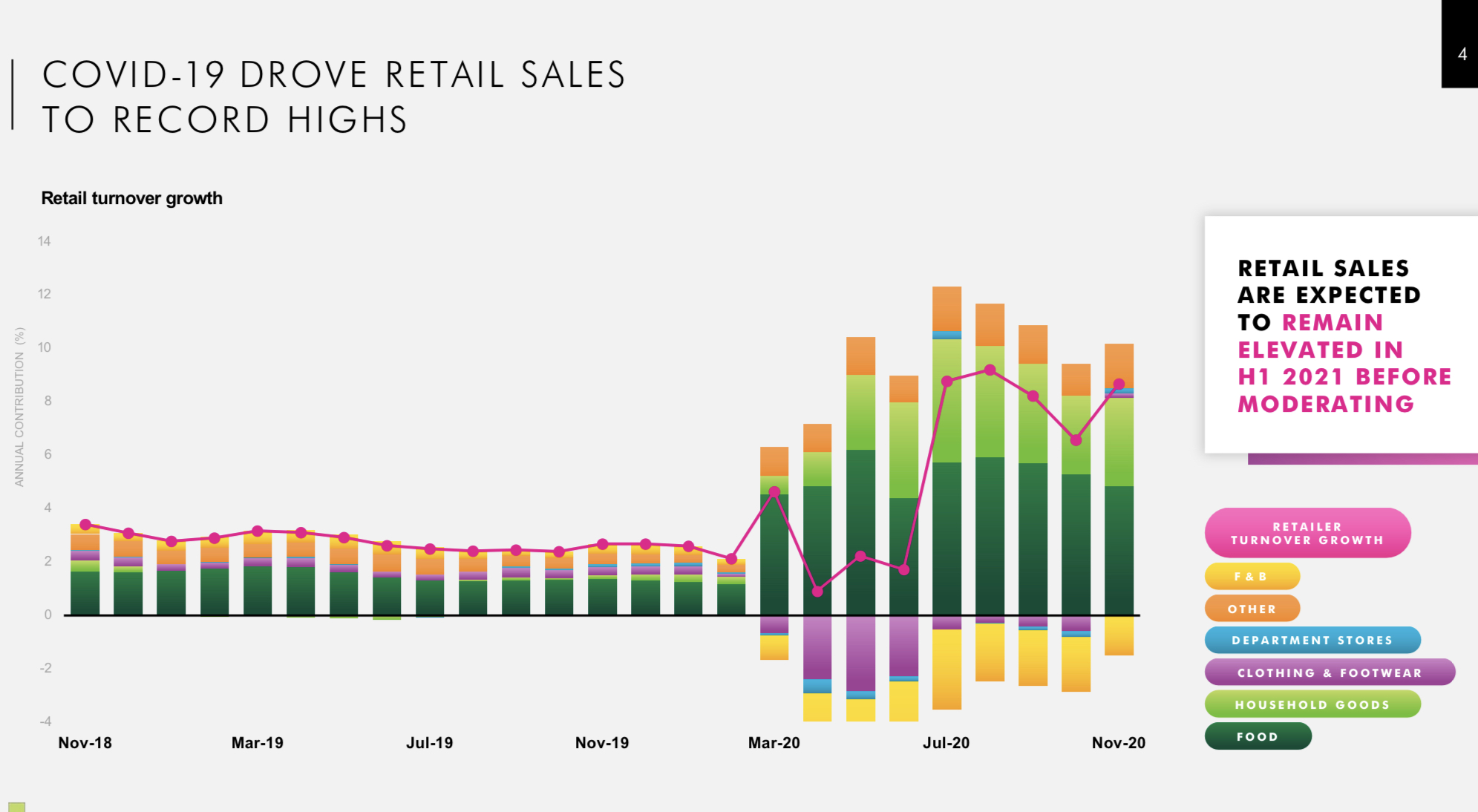

2020 saw the retail sector in Australia recalibrate as lockdowns, trading restrictions and border closures impacted trading conditions and shifted consumer demand.

However, strong retail trade growth has bolstered the retail sector. Record growth in groceries and household goods sales drove investor demand for neighbourhood centres and large format retail. Spend is expected to remain elevated for the first half of 2021, offsetting the impact of lost sales from international tourists due to border closures.

Softer yields when compared to other commercial property sectors along with the opportunity to reposition retail assets to maximise rental growth presents good value to investors and may help support a recovery in retail transactions in 2021.

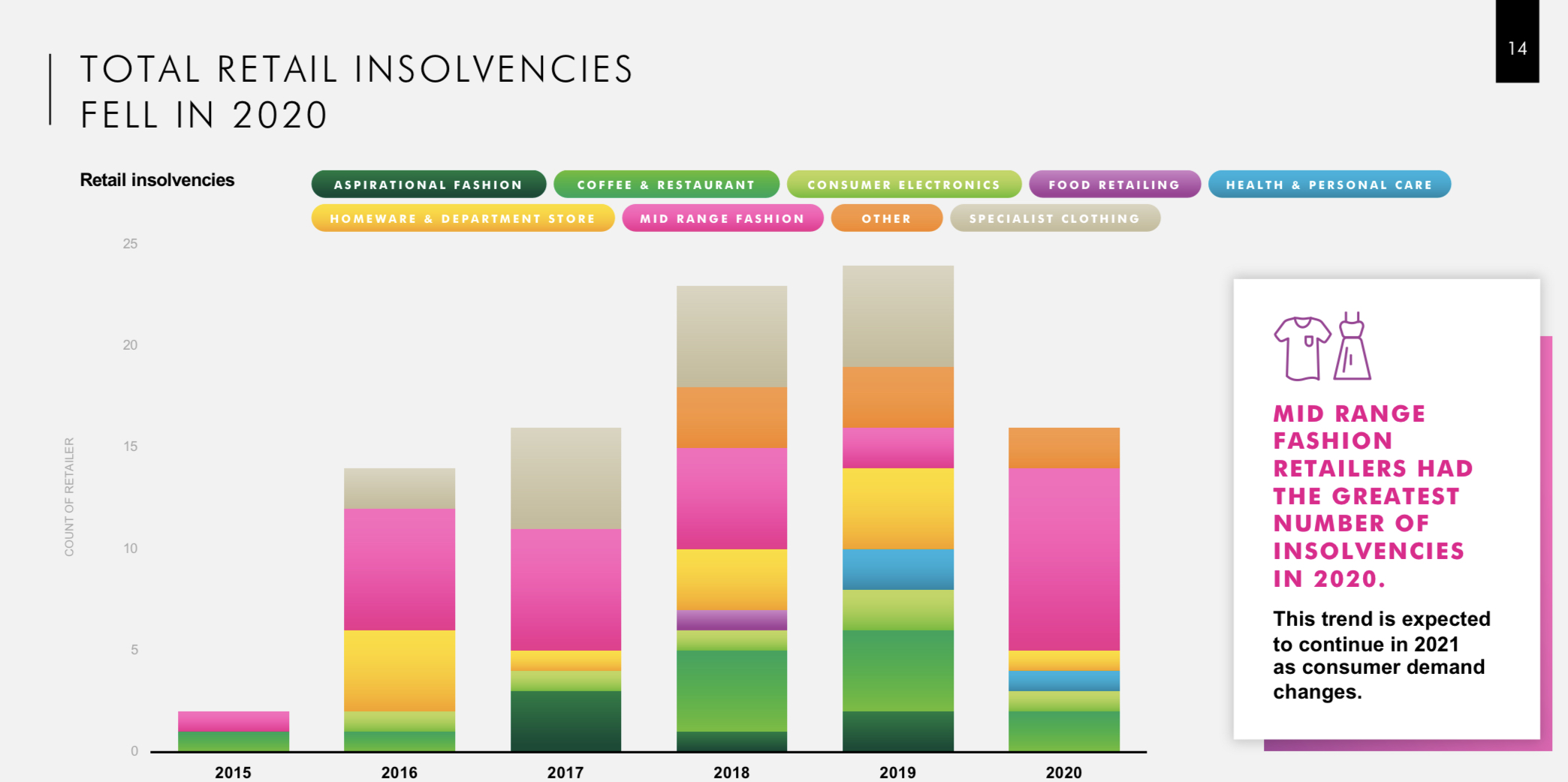

Changing patterns of consumer demand will drive opportunities for investors, landlords and occupiers alike.

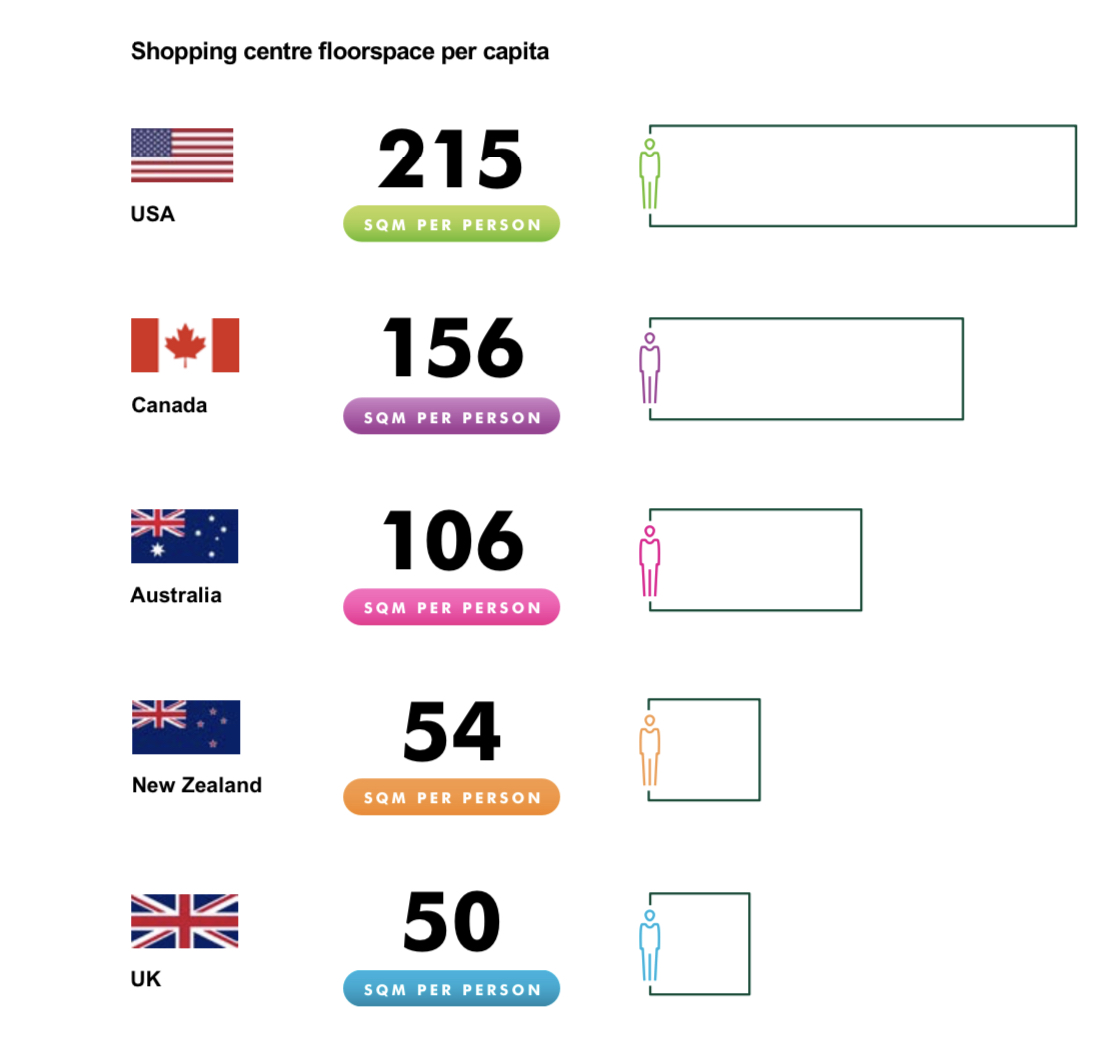

AUSTRALIA HAS A LOWER PROPORTION OF SHOPPING CENTRE SPACE COMPARED TO NORTH AMERICA, LIMITING THE RISK OF OVERSUPPLY.

Close to 46% of total retail space in Australia is located in shopping centres. A key advantage Australia has over North American markets is the proportion of total centre space per capita and the inclusion of supermarkets and fresh food in shopping centres. These factors will help maintain demand for retail floorspace.

AS SALES SHIFT ONLINE, THE AMOUNT OF PHYSICAL RETAIL SPACE REQUIRED PER CAPITA IS SHRINKING

The largest forecast decline in physical retail space will come from department stores, which are expected to decrease 2.6% annually to end-2024. Conversely, homewares and home furnishing stores are forecast to record the strongest growth in floorspace (2.5% CAGR 2020 - 2024), broadly in line with growth between 2015 and 2019.

The report details how changing patterns of consumer demand are driving opportunities for innovative investors, landlords and occupiers.

To request a copy of the CBRE Market Outlook 2021 please email Kate Bailey Head of Logistics and Retail Research CBRE Australia via the contact forms below.